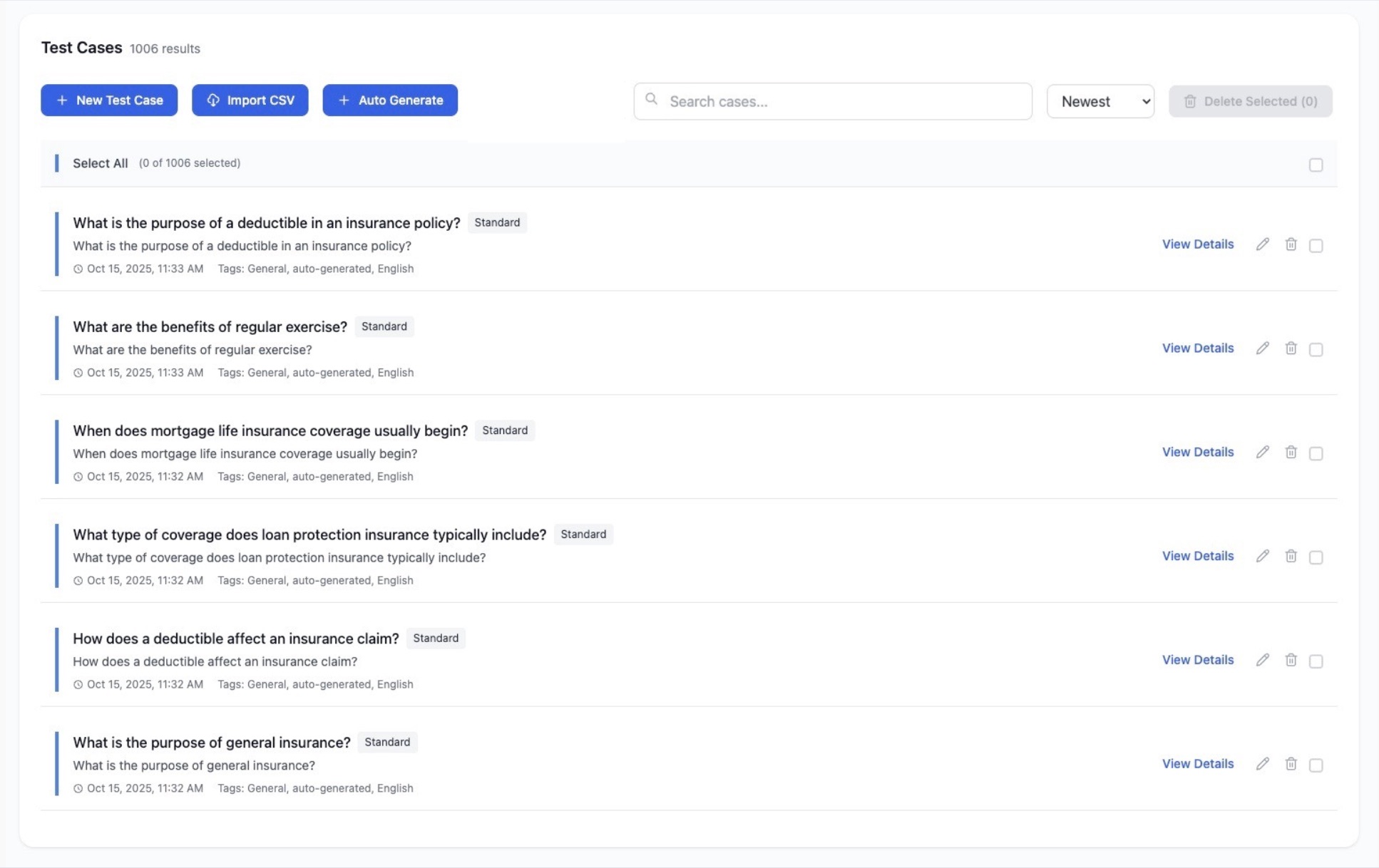

Example: "What's the best credit card available for travel?"

Provides personalized financial guidance and product recommendations to retail banking customers. Our Agents automate this by ingesting product documentation, terms and conditions, and policy documents, enabling instant, accurate answers about credit cards, loans, and banking services with source citations.